Last week I was one of several media persons who participated in the JERA Familiarization Tour in Japan. JERA is the largest power generation company in the country, producing one-third of the total electricity yearly. It was formed only in 2015 with the consolidation of the fuel and thermal power departments of Tokyo Electric Power Co. (TEPCO) and Chubu Electric Power Co.

In 2024, JERA has revenues of $22.4 billion, power generation capacity of 72.7 gigawatt (GW), and presence in 15 countries, nine of which are in Asia and the Middle East. In the Philippines, they have investments in TeaM Energy’s Sual coal plant via TEPCO, and in Aboitiz Power (AP) with a 27% equity share in AP.

JERA toured us through two beautiful power plants, the Hekinan Coal Thermal Plant near Nagoya (4,700 MW capacity), and the Futtso Gas Thermal Plant in Chiba, near Tokyo (5,160 MW capacity). Hekinan is Japan’s largest coal plant and Futtso is Japan’s largest LNG plant and the third largest in the world.

I say “beautiful” coal and gas plants because Japan has industrialized fast via thermal plants from a war-ravaged economy after World War 2. By 1970, Japan was a $1 trillion economy while China was a $634 billion economy, India was $470 billion, Indonesia was $138 billion, and South Korea was a $70 billion economy (source: Maddison Project excel file).

Until 1995, Japan had the most power generation in Asia with 1,011 terawatt-hours (TWh) while China had 1,007 TWh, India had 427 TWh, South Korea had 204 TWh, and the Philippines had only 34 TWh.

In 2014, Futtso and other gas plants produced an all-time high output of 448 TWh while Hekinan and other coal plants produced 353 TWh as all nuclear plants had been temporarily stopped after the disaster in Fukushima.

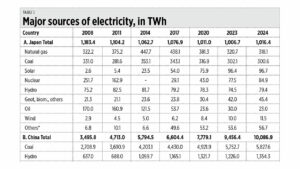

Today, Japan is suffering from declining power generation, going from an all-time high of 1,183 TWh in 2008 to 1,016 TWh in 2024. This is a trend shared by all G-7 countries except the US. In contrast, all Asian countries seen an increase in power generation, led by China with 10,087 TWh in 2024 or nearly 10 times that of Japan and 2.2 times that of the US. Vietnam has tripled its power generation from 2011 to 2024, just 13 years.

Economies with rising power generation, especially from coal like China and Vietnam, tend to see faster GDP growth than those with declining power production including coal like Japan and the US (see Table 1).

One important result of rising power generation, regardless of source, is rising productivity. Data on Philippine merchandise trade shows that the share of China is rising fast, from 20% of our total imports in 2020 to almost 29% in 2025. The US, Japan, Korea and all other Asian nations except Vietnam are losing market share to China (see Table 2).

A rise in imports share means Philippine businesses and consumers see more value for money from the products of those countries, in this case China and Vietnam. This should be another wake up call for Japan and other countries that want to “decarbonize” and pursue “net zero” fast. Developing countries like the Philippines, Indonesia, and Vietnam want net growth and not net zero, more economic prosperity and not energy poverty.

JERA and its mother companies have powered Japan to fast industrialization. JERA can continue powering Japan via expansion of their thermal plants. AP is lucky to partner with such a huge and time-tested company with long experience running thermal plants.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com