Two recent reports on public finance leadership caught my attention.

First was the exit of Bureau of Internal Revenue (BIR) Commissioner Romeo D. Lumagui, Jr., who was replaced by Department of Finance (DoF) Undersecretary Charlito Martin R. Mendoza. And the second was on the reported exit of Executive Secretary Lucas Bersamin who, it is said, will be replaced by DoF Secretary Ralph G. Recto, with Special Assistant to the President for Investment and Economic Affairs Frederick Go to become the new Finance Secretary.

See these reports: “Finance Usec. Mendoza takes over BIR” (BusinessWorld, Nov. 14) and “Bersamin on way out? Not true until it actually happens” (Philippine Star, Nov. 17).

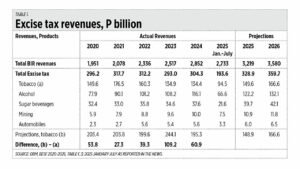

NEW BIR CHIEF AND EXCISE TAXThe new BIR Commissioner, Charlie Mendoza, is no stranger to BIR work because the bureau was under him in his work as DoF undersecretary. Among the challenges for him in his new role is how to arrest the declining share of excise tax revenue to total revenues, from 15.2% in 2020 to 13.4% in 2022, 10.7% in 2024 and only 7.1% from January to July this year.

While excise tax collections from alcohol, sugar-sweetened beverages, mining, and automobiles keep rising consistently, excise tax revenues from tobacco have been declining since 2022. The share of the tobacco tax to total excise tax has been declining, from 55.6% in 2021 to 51% in 2022, 46% in 2023, and 44% in 2024.

The Budget of Expenditures and Sources of Financing (BESF) along with the National Expenditure Program, Staffing Summary, are submitted by the Department of Budget and Management (DBM) on behalf of the Development Budget Coordination Committee (DBCC) to Congress in August of each year. For this column, I compared the revenue projections of the BESF 2020 versus the actual revenues in 2020, BESF 2021 projections vs actual revenues in 2021, and so on.

For tobacco products, there has been a consistent over-projection yearly: P54 billion in 2020, P27 billion in 2021, P39 billion in 2022, P109 billion in 2023, and P61 billion in 2024 (see Table 1).

The main culprit for the decline in tobacco tax revenues is the ever-rising tobacco tax rate. From P50/pack in 2021 to P55/pack in 2022, P60/pack in 2023, P63/pack in 2024, to P66.20/pack this year, and P67.50/pack next year.

As the tax rate goes up, the price differential between legal and illegal or illicit tobacco increases. For instance, in 2024 one could buy illicit cigarettes for only P40/pack in sari-sari (sundry) stores or from ambulant vendors while the cheapest legal cigarettes went for P90-P100/pack because the tax alone was already P63/pack.

Many smokers would prefer to pay P40 rather than P100 a pack even if they know that the former comes from smugglers and illicit traders.

The dual purposes for raising the tobacco tax are to raise more tax revenues, and to reduce the incidence of smoking. Neither happened. Tax revenues declined while smoking incidence has increased as more people buy the cheap but illicit cigarettes.

I have argued before and I will argue again, that the tax rate should be more realistic, that the price gap between legal and illegal products should decline. Then the smuggling and decline in tobacco tax revenues can be arrested.

RECTO AND FOREIGN INVESTMENTSAbout the reports of Secretary Recto becoming the new Executive Secretary — if they are true then I think he is the most qualified official to continue the work. He is a former congressman, a former senator, the No. 2 in the Senate as President Pro-Tempore, and is now head of a huge department in charge of raising revenues for the entire government.

Aside from raising revenues, controlling the increase in public debt stock, and keeping an eye on the high increase in interest payments alone, the administration must make the country’s investment environment more attractive, both to domestic and foreign investors.

I checked the level of foreign investments according to the Philippine Statistics Authority (PSA). Singapore, South Korea, Japan, the Cayman Islands, and the US are the top sources of foreign investments in the country. China’s investors are catching up and may overtake investors from the US by end-2025 (see Table 2).

It is important that the ongoing corruption scandal be resolved soon, and the wrongdoers go to jail, whether they are senators, congressmen, Department of Public Works and Highways officials, private contractors, and so on.

I believe the explanations given by DBM Secretary Amenah F. Pangandaman that a huge P100-billion insertion could not have easily been made at the Bicameral Committee as alleged recently made by former congressman Zaldy Co. That puts a big question mark on Mr. Co’s allegations. It would be fairer for him and the officials he has accused if he returns, makes written and verbal statements under oath, and produces the proof and documents.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com