The ASEAN summit in Malaysia ended on Oct. 28, then the APEC (Asia-Pacific Economic Cooperation) Summit in South Korea ended on Nov. 1. Both annual events focused on trade and economic diplomacy. Then the rotating ASEAN chairmanship for 2026 was passed from Kuala Lumpur to Manila starting Jan. 1 next year.

Also last week, the Philippine Statistics Authority (PSA) released the country’s international merchandise trade statistics for September. In this column, I compare our January-September data for the last three years.

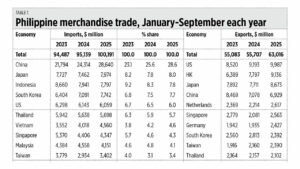

Our merchandise or goods imports have breached $100 billion in January-September this year, and the bulk of that came from China whose share in our total imports has been rising fast, from 23% of total imports in 2023 to 28.6% of total in 2025. The shares of Japan, the US, Indonesia, Thailand, Singapore, and Australia are declining.

Our exports have recovered and reached $63 billion. Our main exports market remains the US, followed by Hong Kong, Japan, and China (see Table 1).

Various surveys show that among ASEAN countries, when it comes to foreign policy the Philippines is the most anti-China and pro-US. But in actual trade, like merchandise imports, Philippine businesses and the public favor China and not the US.

The combined share of China and Hong Kong in imports in 2025 was 30.1%, much larger than the combined share of the US, Japan, Taiwan, Korea, Australia, Germany…

China is a good source of useful physical products like trucks and buses, gadgets and computers, clothes and shoes, while the US is a good source of entertainment like Netflix and Hollywood movies, YouTube, UFC, the NBA, Taylor Swift concerts etc. But we cannot industrialize with entertainment.

PERENNIAL DEFICITOur current and medium-term fiscal condition remains in perennial deficit. Our expenditures endlessly rise even without an economic or health crisis, and our revenues cannot cope with it. The annual deficit of P1.55 trillion a year in the last three years is expected to remain flat in the next three years (see Table 2).

At current rate of increase in our public debt, even if we have a deficit of zero in 2026, with expenditures cut significantly so that there is a balanced budget (revenues equal to expenditures), our outstanding debt stock of P17.5 trillion at around 6% average interest rate (especially the 10-year government bonds) will still increase to P18.05 trillion next year just on the increase in interest payments alone.

This means that we should aspire not only for a balanced budget but a budget surplus. Many current subsidies and freebies must be discontinued, and privatization of government lands and assets should continue.

Meanwhile, on the continuing corruption scandal in the country, these reports in BusinessWorld are generally good: “PHL gets ‘verbal’ assurances from Fitch, Moody’s on outlook” (Oct. 28), “Unprogrammed allocations cap seen deterring GAA ‘insertions’” (Oct. 29), “Budget seen leaving no room for long-term spending items” (Oct. 30), “Philippine government’s outstanding debt slips to P17.46 trillion” (Oct. 31), and, “Q3 underspending to ‘temporarily’ drag growth — Recto” (Nov. 3).

I can understand the concern of Finance Secretary Ralph Recto. Some important infrastructure projects that can contribute to increased productivity would be affected as public suspicion remains high. The problem, however, is that as the budget of the Department of Public Works and Highways has been cut, other sectors could opportunistically sneak in and raise their budgets for 2026, so that the projected deficit will remain high.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com