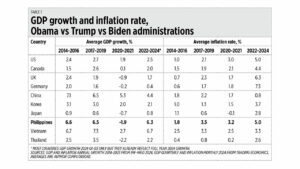

Yesterday, Donald J. Trump started his second term as the 47th President of the USA. I have read a number of articles peddling the narrative that the US and global economy, including the Philippines, was worse off during Trump’s first term. To verify if this was true or not, I constructed this table comparing the average growth and inflation rate performance of three presidential administrations — Barak Obama’s last three years (2014-2016), Trump’s first three years (2017-2019), the COVID lockdown years (2020-2021), and Joe Biden’s last three years (2022-2024).

ECONOMIC PERFORMANCE UNDER 3 PRESIDENTSIn terms of GDP growth, the US economy performed better under Trump than under Obama or Biden. The same for its northern neighbor Canada. The two largest economies in Europe — Germany and the UK — have shown consistent declines in average growth over those three administrations.

The three largest economies of Asia except India, China, and Korea have similar trends as the two European countries but at higher levels. Some ASEAN countries — the Philippines, Vietnam, and Thailand — experienced lower growth under Biden than under Trump.

When considering consumer prices, the US, Canada, Germany, and UK experienced inflations levels that were two to three times higher under Biden than under Trump. A similar trend can be seen for Korea and Japan, the Philippines, and Thailand (see Table 1).

So, the idea that the US and global economy including the Philippines was worse off during Trump’s first term is wrong when comparing GDP performance during the Obama and Biden administrations. But the idea is partially true when compared with the Obama administration on inflation.

‘SHRINK GOVERNMENT’ TREND: ARGENTINA, US, VIETNAMWhen Argentina’s President Javier Milei took office in December 2023, he immediately reduced the number of government ministries from 19 to nine, merging and partially abolishing 10 ministries. A few months later, he further reduced it to only eight ministries. Argentina experienced a budget surplus within two months.

When Trump won the US elections last November, he announced the creation of a Department of Government Efficiency (DOGE) to be jointly led by Elon Musk and Vivek Ramaswamy*, two successful entrepreneurs. Musk, Ramaswamy, and Trump were all inspired by Milei’s huge fiscal reforms and DOGE was created with a clear mandate of reducing the bureaucracies, subsidies, regulations, and taxes that curtail business. DOGE will self-evaporate by July 2026 or just after an existence of 1.5 years, as it is not meant to be a forever bureaucracy.

Now some leaders of US states are thinking of creating their own DOGE, like the governors or legislative speakers of Iowa, New Hampshire, Louisiana, and Wisconsin, with the same goal of shrinking the bureaucracies, subsidies, and regulations.

Meanwhile, the Vietnam Communist Party announced last December that they will cut the number of government bodies from 30 to 21, in a process they labeled as “institutional revolution.” Among the plans is merging the Ministries of Finance, Planning, and Investment to form a new “super ministry” called the Ministry of Finance and National Planning. Then merging the Ministries of Transport and Construction, and Ministries of Labor, Invalids and Social Affairs with Home Affairs.

The Philippines has a National Government Rightsizing Program (NGRP) bill in Congress which aims to merge some agencies and bureaus and have a leaner national bureaucracy. Local government bureaucracies are not covered by the bill. The Department of Budget and Management is pushing this bill and its Secretary Amenah F. Pangandaman is confident that this move will help reduce the annual deficit and borrowings.

SHRINKING TAXESannounced last December that they will abolish 90% of all federal or national taxes (not revenues) and have at most only six different taxes on businesses and individuals.

US President Trump plans to further cut US corporate income taxes to 15% hopefully this year, to be implemented in 2026.

The are no similar plans to cut taxes in the Philippines but Finance Secretary Ralph G. Recto has maintained that there will be no tax hikes, and pushed only old tax measures, like a tax on digital transactions to level the playing field with physical transactions.

Recently a bill on a moratorium on sustained increases in the tobacco tax was filed in Congress. I was invited by the House Committee on Ways and Means, chaired by Joey Salceda, and the Senate Committee on Ways and Means chaired by Win Gatchalian. I have attended meetings at both the House and Senate.

The Food and Nutrition Research Institute (FNRI), an agency under the Department of Science and Technology, showed one result of their 2023 survey covering some 36,000 households, or about 150,000 individuals, nationwide. Smoking incidence among respondents who were 20 years old and above increased from 18.5% of adults in 2021 to 23.2% in 2023, a big jump of 4.7%, equivalent to 3.45 million more smokers.

The continued rise in the tobacco tax is supposed to achieve two outcomes: reduce the number of smokers and increase the value of tax revenues. From 2021 to 2023 neither happened. The reverse happened — there were more smokers, and there was a decline in tobacco tax revenues (see Table 2).

The main explanation for this is that many smokers of legal tobacco did not stop smoking or reduce their consumption but instead shifted to illegal tobacco which is dirt cheap. So, the higher tobacco tax rate benefited only smugglers, criminals, terrorist organizers in cahoots with their protectors in government, while tax collections for healthcare declined.

I argued in both the House and Senate Committee meetings that the optimal tax rate is P50/pack because it was the rate that gave the DoF P176 billion in 2021. So, if we want to collect more tobacco tax revenues, the tax rate should be rolled back to P50, not increased to P63, and certainly not P70 a pack.

*Fox News said yesterday that Ramaswamy is expected to pursue the governorship of Ohio instead of taking up the reins of DOGE.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com