Last week the Philippine Statistics Authority (PSA) released three important pieces of economic data for 2025 — our low inflation rate of 1.7% for October; a low unemployment rate of 3.8% for September; and modest GDP growth of 4% for the third quarter (Q3) of this year.

So, two pieces of good news, and one rather poor piece of news on growth — it is lower than the 5.5% to 6.5% full-year growth target expected by the government’s economic team, and also lower than the projection of 18 economists polled by BusinessWorld whose median projection was 5.3% for Q3.

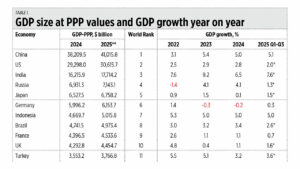

Last month, the IMF released an update of the World Economic Outlook (WEO) database. In one table here, I show the GDP size of countries and economies at Purchasing Power Parity (PPP) values. Then their respective growth over the last three years, and my updated quarterly global monitoring of GDP performance.

Looking at it, one sees that China remains the largest economy in the world and its gap with the US has increased from 2024 to 2025. This year Taiwan overtook Australia for the 20th spot, Vietnam overtook Bangladesh for the 23rd spot, and the Philippines is supposed to overtake Malaysia for the 30th spot but with the growth slowdown, this may not happen.

From Q1-Q3 2025, of the top 50 largest economies in the world, the fastest growing has been Vietnam with 7.8%, second is Taiwan with 7%. India has no Q3 data released yet, but if it is 6.5% or higher it will be in second place and Taiwan in third. China is fourth, Indonesia and Philippines are tied in fifth place with 5% (see Table 1).

DECLINING INFLATIONOur declining inflation rate — from 6% in 2023 to 3.2% in 2024 and 1.7% from January-September this year — is a welcome development for our people.

In a press statement, Department of Finance (DoF) Secretary Ralph G. Recto highlighted the “government’s strong commitment to protecting the country’s poorest households, keeping headline inflation low at 1.7% and only -0.4% for the bottom 30% in October through sustained measures to stabilize prices and maintain economic momentum.”

Yes, I see that. The DoF and the rest of the economic team should continue the low-inflation policy measures as these will have short- and medium-term positive impacts in improving consumer confidence. And this will translate into higher household consumption, which is about 74% of GDP.

Meanwhile, Japan is now the “inflation capital” of East Asia, while China is in deflation mode, from a low 0.2% in 2023 and 2024 to -0.1% this year (see Table 2).

DECLINING UNEMPLOYMENTOur low unemployment rate of 3.8% for September is similar to the full-year unemployment rate of 2024. It is at an all-time low since the 1980s. Budget Secretary Amenah F. Pangandaman said in a Viber message that “government spending in various sectors has contributed to more job opportunities for our people.”

The Philippines should grow 6-8% yearly for at least seven years to land in the top 25 largest economies in the world, overtaking Bangladesh and even Thailand. But with the ongoing corruption scandals and souring of investments, the more realistic growth target would be 5-6% yearly until 2028. High sustained growth should translate into more jobs and business opportunities for our people, which will bring down the unemployment rate further to 3.5% or lower.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com