On Oct. 15, the Property Rights Alliance (PRA, US) — a sister free-market think tank of the Tholos Foundation of which I am among the international fellows — released the International Property Rights Index (IPRI) 2025, holding its global launch in Brussels, Belgium at the EU Parliament. The report was authored by Dr. Sary Levy-Carciente, a Hernando de Soto Fellow, and edited by Lorenzo Montanari, Executive Director of the PRA.

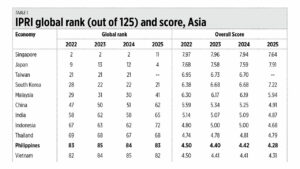

The IPRI is composed of three core components: Legal and Political Environment (LP), Physical Property Rights (PPR), and Intellectual Property Rights (IPR). I included the results for 2025 and the results of the previous three years in the accompanying table. The Philippines is not faring well mainly due to our low score in LP, meaning the legal and institutional issues that cover the extent of corruption, among other factors. So far, we are at similar level as Vietnam. (See Table 1.)

The ongoing large-scale corruption scandal involving just the Department of Public Works and Highways (DPWH) and not including — yet — many other departments with their own skeletons in the closet, is adversely affecting the country’s investment environment, credibility of other reform programs especially in fiscal economics, and the public’s declining respect for both the Executive and Legislative branches.

CALAMITIES AND POWER EXCHANGEThere have been many strong storms then big earthquakes (especially in Cebu and Davao) this month alone. There is a need for energy independence of certain island-provinces in case the transmission lines and cables serving the Panay-Negros-Cebu, Leyte-Bohol sub-grids, and the Mindanao-Visayas grid, are damaged or destroyed.

I checked the power exchange among the three grids in Luzon, Visayas, and Mindanao. Last September (and likely until early October), Visayas was importing more power from both Luzon and Mindanao.

Last month, the Luzon to Visayas transfer occurred 86% of all time while that of power from Mindanao to Visayas occurred 92% of all time (see Table 2).

Visayas has recently been importing power almost 24/7, but power demand in both Luzon and Mindanao is also rising. Within the Visayas, Cebu and Panay islands are coal-powered and they export extra power to Negros which has zero coal and plenty of solar power.

Anti-coal sentiment, especially from the multilaterals like the United Nations and ADB continues through their Energy Transition Mechanism (ETM) program — see these reports in BusinessWorld: “DoE, UN agency studying impact of energy transition on coal industry” (Sept. 3), “Power plant retirement to be eligible for carbon credits” (Oct. 13), “DoE clarifies coal moratorium rules; allows new capacity only in exceptional cases” (Oct. 17).

The ADB’s anti-coal sentiment should inspire them to move their headquarters from the Philippines (which uses coal for 55% in total power generation) to Myanmar or Nepal which use coal for only 4% and 7% of their total generation, respectively.

I bumped into the president and CEO of Meralco Power Gen (MGEN), Manny Rubio, and I asked him about the recent pronouncement by the Department of Energy (DoE). He optimistically replied that “The DoE’s clarification of the coal moratorium provides a pragmatic approach to balancing the country’s energy transition with the realities of our supply reliability. By allowing limited exemptions for off-grid areas, industrial own-use, and critical mineral processing, the policy recognizes the need for dependable baseload power in regions still facing transmission and supply constraints.”

This week the Energy Regulatory Commission (ERC) held a press conference about their accomplishments over the last two months and their targets until end-2025. Among the papers released by the ERC that caught my attention was the increase in the Feed in Tariff Allowance (FIT-All) in our monthly electricity bill to 20.73 centavos/kWh, to be collected starting next month.

The FIT-All rates in centavos per kWh were: 18.3 in 2017, 22.3 in 2019, 9.8 in 2021, zero in 2023, 8.4 in 2024, and 11.9 until this October. See Table 2 of this column last week, “Coal for energy security, infrastructure for energy resilience” (Oct. 14).

So, an increase from 11.9 to 20.7 centavos/kWh next month is high and most of this will go to wind and solar-eligible plants. The owners of these plants are not the ordinary rich, but the super-rich conglomerates that own no coal plants (which are cheap, stable, and reliable energy sources).

In a few years, we will pay not just FIT-All but also GEA-All in our monthly electricity bills, especially to huge offshore wind farms under the green energy auction (GEA) program. This GEA-All will be much higher than FIT-All. One ADB estimate quoted by a friend and fellow columnist Myrna Velasco showed that offshore wind will charge P12-P15/kWh.

If this number is correct, compared with the current WESM average price of P4/kWh, then the GEA difference will be P12-15 minus P4 equals P8-11/kWh multiplied by their GWH generation. That guaranteed high price GEA minus WESM price will be the GEA-All and we will pay more for electricity.

The anti-inflation policies of the economic team and the Bangko Sentral will be cancelled by the expensive wind projects and lobby. Woe unto us consumers.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com