The spending side of the Philippines’ public finance needs major reforms that include spending cuts in many agencies like the corruption-tainted Department of Public Works and Highways (DPWH). Instead, we can increase infrastructure projects via Public-Private Partnerships (PPP).

The revenue side too needs additional reforms, especially when it comes to excise tax because the declining trend continues with more privatization of government assets, and with rising dividends given by government-owned and -controlled corporations (GOCCs).

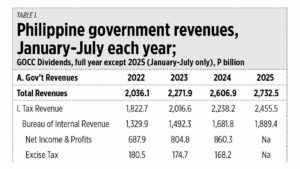

Bureau of Internal Revenue (BIR) collections continue their natural annual increase even without any major tax hikes; it is the Bureau of Customs that needs dynamism (see Table 1).

“A closer look at some indicators will belie Secretary [Ralph] Recto’s statements. The seemingly satisfactory revenue effort is deceiving. Note that ‘better-than-expected’ nontax revenue collections primarily drove higher total revenue collections. These nontax revenues included public-private partnership concession fees amounting to P30 billion, and notably, P167.2-billion transfer of funds from two government-owned and -controlled corporations (GOCCs), the Philippine Health Insurance Corp. (PHIC) and the Philippine Deposit Insurance Corp. (PDIC).”

That paragraph is from “Binding constraints: Corruption and limited fiscal space” by Pia Rodrigo and Filomeno S. Sta. Ana III, a story in BusinessWorld’s Anniversary Report, which came out earlier this month. The above statement on the transfer of PHIC and PDIC funds to the national treasury as non-tax revenue is not accurate. As shown in Table 1, a big Land Bank of the Philippines dividend of P32 billion last year constituted a big increase in non-tax revenues.

The needed reforms in excise tax relate mainly to tobacco taxes. Revenues from alcohol, sugary drinks, mining, and automobile keep rising or remain steady; it is the revenue from tobacco that keeps declining as the tax rate increases. Tobacco smugglers and their corrupt protectors in government love high tobacco tax rates because the price gap between legal or taxed products and illegal or untaxed products becomes wider. Smokers and vapers naturally want cheap products, and illicit and smuggled tobacco are sold at lower prices.

It is wrong for health activists and agencies to depend on tobacco and alcohol taxes to fund public health. Many health activist groups want to stop people from smoking and vaping completely, so one assumes that they wish that tobacco tax revenues would someday be zero. Yet they demand more billions of pesos from more smokers and drinkers who pay higher tobacco and alcohol taxes.

Any tobacco and alcohol tax revenue should go to the National Treasury, with zero earmarked for the Health department or for the Philippine Health Insurance Corp. (better known as PhilHealth). That way, there is zero dependence on smokers and drinkers.

INFRASTRUCTUREMeanwhile, the economic and infrastructure teams went to Osaka, Japan last week for a Philippines Economic Briefing on Sept. 12. There was also the Philippines-Japan High-Level Joint Committee Meeting on Infrastructure Development and Economic Cooperation on Sept. 11.

The Philippine delegation was led by Finance Secretary Ralph G. Recto. The delegation included Economics Secretary Arsenio Balisacan, Trade Secretary Ma. Cristina Roque, and Energy Secretary Sharon Garin. Budget Secretary Amenah Pangandaman was not there as she was facing and addressing spending concerns on DPWH flood control projects and other agencies at the Senate hearings and other venues.

I checked the status of the Philippines’ credit rating with respect to its neighbors in Asia. We are just one notch from attaining an “A” rating from the Big Three agencies — S&P, Moody’s, and Fitch — while we have already secured an “A” from Ratings and Investment (R&I, Japan) and the Japan Credit Ratings Agency (JCRA), as seen in Table 2.

Improved credit ratings would mean the lower cost of government borrowings to cover domestic infrastructure and social services spending. While this is a good way towards fiscal consolidation, a better way is to cut spending somewhere, like abolishing old subsidy programs when new subsidy programs are created.

Also, there should be major reforms in the military and uniformed personnel (MUP) pension system. Active duty personnel should contribute to their own pensions someday. A pension fund is personal, not social or collective, so its funding should also be personal, not social or collective. And the indexation of retired personnel’s pensions to the salaries of active personnel of equal rank should be abolished.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com