President Donald J. Trump’s proposed “Liberation Day” tariffs — an across-the-board 10% levy and a targeted 245% tariff aimed at China — are both dramatic and entirely in line with his long-standing protectionist agenda. Whether these measures are ultimately enacted, softened, or abandoned, their announcement alone has rattled global markets and highlighted the fragility of international trade. For the Philippines, the implications go beyond macroeconomics — they are beginning to register across real estate, particularly within the industrial and office segments.

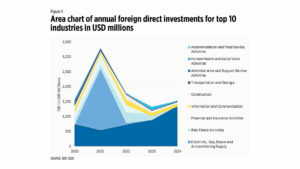

THE PHILIPPINES IS LEVERAGING TRADE INSTABILITY TO POSITION ITSELF AS A SECONDARY MANUFACTURING HUBAlthough global trade volatility has revived fears about the long-term future of globalization, the Philippines is actively attempting to turn crisis into opportunity. The Philippine Economic Zone Authority (PEZA) has championed the country as a “China+1+1” destination — a fallback manufacturing location for companies moving beyond China and its first-wave alternatives like Vietnam and Taiwan. This positioning is already bearing fruit. In 2024, 95% of total foreign direct investment (FDI) in the Philippines went to manufacturing, and from 2021 to 2024, the sector posted a 38.63% compound annual growth rate.

STRUCTURAL CHALLENGES CONTINUE TO WEIGH DOWN THE PHILIPPINES’ MANUFACTURING INVESTMENT POTENTIALYet this momentum comes with persistent obstacles. High electricity costs, regulatory friction, and unpredictable policymaking continue to hinder the country’s ability to fully convert investor interest into sustained industrial activity. According to the Department of Energy, the Philippines has the third highest industrial electricity rate in ASEAN — behind only Cambodia and Singapore. In 2024, the country ranked 49th out of 67 in the IMD’s global anti-red tape index and 114th out of 180 in Transparency International’s Corruption Perceptions Index, with a score of just 33. International trade agencies such as the US Department of State and Export Development Canada have also pointed to regulatory inconsistency and political uncertainty as deterrents to investment.

PHILIPPINE EXPORTS ARE 16.8% US-BOUND, HIGHLIGHTING VULNERABILITY BUT ALSO ROOM TO DIVERSIFYMr. Trump’s tariff rhetoric has also reignited fears among Philippine exporters. The US is the Philippines’ single largest export market, absorbing 16.8% of exports in 2024 — worth over $12 billion. While electronics dominate the basket (including integrated circuits and office machine parts), the US also buys substantial volumes of coconut oil, leather goods, and agricultural products. Should a proposed 17% tariff on Philippine goods materialize, it could create headwinds across numerous industries.

Still, the Philippines’ export portfolio is not overly concentrated. Japan (14.1%), Hong Kong (13.1%), and China (12.9%) closely follow the US, suggesting that smart policy and market development could help diversify demand and cushion shocks.

A PERSISTENT PRODUCTION SHORTFALL DRIVES THE PHILIPPINES TO IMPORT 7.2 MILLION METRIC TONS OF STEEL ANNUALLYOne of the less visible, yet highly consequential, ripple effects of the trade war is its influence on construction material costs — particularly steel. The Philippines produces just 1.5 million metric tons of crude steel annually, on average, according to the World Steel Association. Domestic output covers only a fraction of national demand, forcing the country to import around 7.2 million metric tons per year. Roughly 67% of these imports come from China, based on 2024 data from the Philippine Statistics Authority.

Meanwhile, China’s share of steel exports to the United States has fallen drastically — from 8% in 2014 to just 2.1% in 2023. With US tariffs pushing Chinese suppliers out of the American market, many of those exports may be redirected to Asia, including the Philippines. As a result, input costs for developers could soften despite global tension — especially for steel-intensive projects in industrial and infrastructure sectors.

WITH US STEEL IMPORTS FROM CHINA DOWN 75%, PHILIPPINE CONSTRUCTION MAY BENEFIT FROM REDIRECTED SUPPLYAmid rising trade barriers, Chinese steel producers are likely to seek alternative destinations for surplus inventory. As US demand drops further under tariff pressure, the Philippines could benefit from excess supply. Given that 80% of the country’s steel consumption is used in construction, lower prices could directly reduce development costs — potentially accelerating project timelines and making new industrial zones more financially viable.

This is a key consideration in assessing industrial real estate’s medium-term outlook. Falling input costs may catalyze new warehousing, logistics, and manufacturing facility construction at a time when global investors are exploring alternative supply chain routes.

THE OUTSOURCING SECTOR IS PROJECTED TO GROW LESS THAN 7% IN 2025 AMID GEOPOLITICAL UNCERTAINTYIn the services sector, particularly in office real estate, the BPO industry faces its own set of pressures. While trade tariffs don’t directly affect services, the Philippines’ strong reliance on US clients exposes the industry to secondary risks. North America accounts for 70% of Philippine outsourcing demand. The sector also contributed $7 billion — or 9% of national GDP — and drove 19% of office demand in 2024.

IBPAP forecasts slower growth in 2025, with the sector expected to expand by less than 7%. While BPO will remain foundational to the office market, risks from reshoring (returning operations to the US) and nearshoring (relocating to nearby countries) will temper expansion. Still, the sector’s fundamentals remain intact, and strategic interventions can help maintain competitiveness.

LOWERING ELECTRICITY COSTS COULD UNLOCK BROADER INDUSTRIAL CAPACITYOne policy lever that could unlock multiple benefits is addressing energy affordability. In the short to medium term, the government could consider targeted subsidies for energy-intensive industries — especially manufacturing. In 2024, 70.9% of all energy investment pledges were committed to renewable energy. While this signals progress toward long-term sustainability, short-term competitiveness will require bridging the affordability gap.

Vietnam once implemented cross-subsidization mechanisms to keep industrial power costs competitive. Germany has proposed covering up to 80% of power costs for energy-heavy sectors like steel and chemicals. A similar intervention in the Philippines could attract more foreign manufacturers and alleviate cost pressures for domestic producers.

UPSKILLING AND POSITIONING THE PHILIPPINE WORKFORCE AS ‘AI-READY’ WILL SUSTAIN BPO SECTOR GROWTHThe BPO sector’s other challenge is technological disruption. But here, the Philippines shows promise. A 2024 Microsoft Philippines and LinkedIn study found that 86% of Filipino knowledge workers use AI at work — well above the global average of 75%. This positions the country not as a laggard, but as a potential leader in human-AI complementarity.

By investing in AI upskilling and moving up the value chain — toward healthcare, finance, and analytics — the Philippines can future-proof its BPO sector. Rather than being displaced by AI, the workforce can evolve with it.

STRATEGIC FRICTION IS A TEST — AND AN OPENINGTrade wars are a symptom of a fractured global order, but they also expose underlying weaknesses — and hidden advantages. For the Philippines, the challenge is not only to weather the storm, but to position itself for what comes after. With the right supply-side reforms, forward-looking workforce development, and sector-specific interventions, the country can convert external turbulence into long-term opportunities.

Jet Yu is the founder and chief executive officer of PRIME Philippines, a commercial real estate advisory firm.