In comparing the GDP size of countries, I use the purchasing power parity (PPP) values, not current values for two reasons. One is that PPP adjusts prices of a comparable basket of commodities that reflect varying standards of living in various nations, each of which has its own currency. And two, PPP values are consistent with electricity generation numbers, and these are in terawatt-hours (TWh), not in currency values.

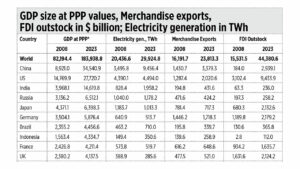

For this column I have compared the data of major economies in the world plus ASEAN-5 in 2008 and 2023, 15 years apart. I took GDP size — the values of the flow of goods and services in one year — at PPP values, and compared it with levels of power generation, merchandise (or goods) exports, and foreign direct investment (FDI) outward stock or net of inflows minus outflows accumulated through the years.

Comparing China and the US, one sees that in GDP size at PPP values, China overtook the US in 2016 — $18.85 trillion vs $18.80 trillion, respectively. When it comes to power generation, China overtook the US in 2011, with 4,713 TWh vs 4,363 TWh, respectively. In merchandise exports, China overtook the US in 2007 — $1.22 trillion vs $1.15 trillion. But in FDI outward stock, China is still way behind the US — but China’s expansion has been big, going from $184 billion in 2008 to $2.94 trillion in 2023, expanding by 16 times over the last 15 years.

I used FDI outward stock in the table, not inward stock because I want to know by how much countries have evolved from being net recipients of capital to being exporters of capital.

Let us compare the ASEAN-5 in FDIs. In 2023, the Philippines’ FDI inward stock was only $119 billion, Malaysia’s was $207 billion, Vietnam’s $229 billion, Thailand’s $291 billion, and Singapore’s was $2.63 trillion — an outlier in the ASEAN. In FDI outward stock in 2023, the Philippines’s was $68 billion, larger than Vietnam’s $14 billion (see the table). Philippine multinational companies like Jollibee, SM, San Miguel Corp., Unilab, and Ayala banner the country in foreign investments abroad.

THE POWER OF POWERHow China overtook the US in GDP size, in merchandise exports, and other major indicators, I think is due to China’s huge expansion in power generation. In 2023, it had twice the capacity of the US, nine times that of Japan, 18 times that of Germany, and 33 times that of the UK. So, China can do all sorts of energy-intensive manufacturing, run big hotels and resorts, malls and theme parks, hospitals and universities, and not worry about blackouts or expensive electricity because the supply is so big.

And of China’s 9,456 TWh in total generation, 61% comes from coal, 13% from hydro, and 5% from nuclear. China has expanded its solar-wind power generation recently, but such is only addition, not a substitution for or transition away from coal power.

For context, the Philippines’ total generation of 119 TWh in 2023 was equivalent to only five days of China’s generation. That is how small our economy and power generation are, or how large China’s are. Aside from having a huge population and hence a huge demand for power, since China is a socialist country it has huge state-led power generation and transmission infrastructure through the State Grid Corp. of China (SGCC) — which also happens to be the owner of 40% our own National Grid Corp. of the Philippines (NGCP).

China has electricity price control too, like our secondary price cap at the Wholesale Electricity Spot Market or WESM. Their National Energy Administration under the National Development and Reform Commission is like our Energy Regulatory Commission. But their price regulation function is secondary to their heavy power generation function, so that “cheap but not available” electricity and blackouts are not a problem there but a regular threat here.

Recently the Maharlika Investment Corp. (MIC) invested in the NGCP and I think it was a good move. I want to mention my former classmate and batchmate (1984) from the UP School of Economics (UPSE), Gladys Cruz-Sta. Rita. Gladys joined the MIC last week as Vice-President for Investment Management Group (Power). She is a good addition there because she was the Provincial Administrator of Bulacan province under three different governors, and was a president of the National Power Corp. Her extensive experience in running a government bureaucracy and in the power sector should help the MIC make prudent investments, especially in the energy sector.

Another batchmate from UPSE 1984 is Lynette Ortiz, President of the Land Bank of the Philippines (LANDBANK). Last week, LANDBANK received an upgraded Viability Rating from Fitch Ratings, rising from ‘BB’ to ‘BB+’. When LANDBANK contributed to the MIC’s capital fund, many analysts predicted there would be a deterioration of LANDBANK’s financial condition. They were wrong, with the ratings upgrade serving as a testament of improved standalone financial strength. Congratulations batchmates Lynette and Gladys.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com