YIELDS on government securities (GS) mostly climbed during the last trading week of the year as market players repositioned ahead of the start of 2025 and priced in policy hints from the US Federal Reserve.

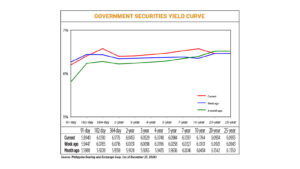

GS yields, which move opposite to prices, went up by an average of 4.7 basis points (bps) week on week at the secondary market, based on the PHP Bloomberg Valuation Service Reference Rates as of Dec. 27 published on the Philippine Dealing System’s website.

GS volume traded decreased to P29.61 billion last week from P24 billion a week prior. The market was closed on Dec. 24 and 25 for the Christmas holidays.

Rates at the short end of the curve were mixed. Yields on the 91- and 182-day Treasury bills (T-bills) decreased by 5.07 bps to 5.894% and 2.55 bps to 6.051%, respectively. Meanwhile, the 364-day tenor rose by 10.6 bps to 6.1776%.

At the belly, yields rose across all tenors. The rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) climbed by 4.22 bps (6.0453%), 4.31 bps (6.0529%), 5.52 bps (6.0748%), 7.26 bps (6.0984%), and 10.7 bps (6.1397%), respectively.

At the long end, the 10- and 20-year T-bonds climbed by 16.63 bps and 0.13 bp to yield at 6.1764% and 6.0934%, respectively, while the 25-year tenor inched down by 0.1 bp to end at 6.0933%.

“The shortened week coupled with the holiday season move basically contributed to the lack of interest in the secondary market,” Dino Angelo C. Aquino, vice-president and head of fixed income of Security Bank Corp., said in an e-mail. “2024 is all but done and most players are now looking ahead to 2025 where more uncertainties may arise.”

Bets on the Fed’s policy stance also affected yields, he added.

“Hawkish forward guidance from US Federal Reserve Chair Jerome H. Powell pushed US Treasury rates higher, creating ripple effects in global bond markets. Locally, heightened dollar-peso volatility prompted a defensive stance among investors. This combination of external and domestic factors contributed to a steepening of the local yield curve as investors grew more cautious about holding long-duration bonds,” ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said in an e-mail.

Mr. Powell said earlier this month that US central bank officials “are going to be cautious about further cuts” after an as-expected quarter-point rate reduction, Reuters reported.

The US economy also faces the impact of President-elect Donald J. Trump, who has proposed deregulation, tax cuts, tariff hikes and tighter immigration policies that economists view as both pro-growth and inflationary.

Traders are pricing in 37 bps of US rate cuts in 2025, with no reduction fully priced into money markets until May.

Higher US rate expectations pulled the 10-year Treasury yield, which rises as the price of the fixed-income instrument falls, to its highest since early May early on Thursday, at 4.641%. It was last up 4.6 bps at 4.625%.

The two-year Treasury yield, which tracks interest rate forecasts, eased 0.4 bp to 4.328%. US debt trends also sent euro zone yields higher.

Meanwhile, on Friday, the peso closed at P57.845 versus the dollar, strengthening by 12.5 centavos from Thursday’s P57.97 finish, supported by holiday-driven remittance inflows.

This was the local unit’s best close in three weeks or since it ended at P57.735 on Dec. 6.

Week on week, the peso jumped by 96.5 centavos from its P58.81-a-dollar finish on Dec. 20.

“Additionally, the announcement of increased bond supply, coupled with lingering concerns over inflation and uncertainties surrounding the US labor market, continued to weigh on the bond market, amplifying the cautious tone in trading,” Mr. Ulpo added.

“The National Government’s planned borrowings contributed to upward pressure on yields, particularly on the medium to long-tenor securities, as investors priced in the anticipated increase in bond supply.”

The government is looking to borrow P629 billion from the domestic market in the first quarter of 2025, the Bureau of the Treasury said last week. Broken down, it wants to raise P264 billion from T-bills and P365 billion via T-bonds.

GS yields may climb further to start 2025, both officials said. The local market is closed for holidays on Dec. 30, Dec. 31, and Jan. 1.

“Overall, yields may adjust higher with a yield steepening bias. We expect to see short-end rates likely to remain steady due to reduction in monetary policy rates, while medium to long tenor bond yields may rise in anticipation of increased supply,” Mr. Ulpo said.

“We could see further consolidation at current elevated levels… We do expect flows to pick up [this] week with decent two-way interest. As US markets will still be open until Dec. 31, movements in rates locally would highly depend on how rates in the US close for 2024,” Mr. Aquino said.

However, hawkish monetary policy expectations “would not bode well for bonds,” he said.

“Positive guidance from the Bangko Sentral ng Pilipinas (BSP) on inflation and liquidity conditions could provide some relief for front-end bonds, particularly as market participants begin to price in the possibility of another rate cut in the near future. However, concerns over supply and external developments will continue to shape trading dynamics, keeping investors cautious,” Mr. Ulpo added.

BSP Eli M. Remolona, Jr. this month said that the Monetary Board is open to delivering another rate cut at their first meeting of 2025 as the Philippine central bank remains in an easing cycle and is “neither more dovish nor less dovish.”

However, delivering 100 bps worth of cuts next year may be “too much,” Mr. Remolona said.

The Monetary Board on Dec. 19 cut benchmark interest rates by 25 bps for a third straight meeting to bring the policy rate to 5.75% from 6%.

The BSP has reduced borrowing costs by 75 bps so far since the start of its easing cycle in August. — Pierce Oel A. Montalvo with Reuters